Journal Articles

BUSINESS STRATEGY AND FIRM LOCATION DECISIONS: TESTING TRADITIONAL AND MODERN METHODS

This paper, written by Patrick L. Anderson for the January 2019 issue of the NABE’s Business Economics journal, is the recipient of a 2018 Edmund A. Mennis Contributed Paper Award. The work earned Mr. Anderson his third Mennis award for the nationally-recognized accuracy of its analysis in handicapping location bids for Amazon’s “HQ2.” In this article, the decision modelling capability of the Rapid Recursive Toolbox is pitted against both traditional and exotic location prediction techniques.

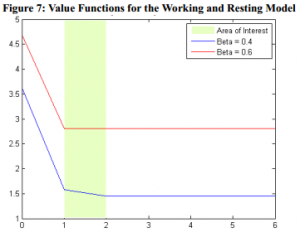

PERSISTENT UNEMPLOYMENT & POLICY UNCERTAINTY: NUMERICAL EVIDENCE FROM A NEW APPROACH

Patrick Anderson, our executive chairman, used the Rapid Recursive® Toolbox for his paper “Persistent Unemployment & Policy Uncertainty,” published in the January 2014 edition of Business Economics. Patrick won the 2013 Edmund A. Mennis award from the National Association of Business Economics (NABE) for this paper.

In the recovery from the United States’ 2009 recession, unemployment has proven resistant to both aggressive fiscal policy and expansionary monetary policy. A possible explanation is the policy cost uncertainty hypothesis. For this, Patrick used a novel “value functional” or “recursive” model of firm behavior, in which managers maximize the value of the business rather than its profits. Using this approach, he demonstrated that policy cost uncertainty affects the hiring decisions of firms, that the response to policy uncertainty is higher in some industries than others, and that the scale of the firm also affects its sensitivity to policy risk.

CASE STUDIES

OPTIMIZING PROMOTIONAL STRATEGY WITH RAPID RECURSIVE®

This case study demonstrates the capabilities of our Marketing & Promotional Strategy solutions by applying them to a large, publicly available dataset of charitable donors. This particular organization had a history of successful mail campaigns, however, they had an opportunity to improve. Read this case study to see how we were able to predict customer responses to within 3% over a 12 month period. Our strategy suggestion would have improved profits by 30%.

VALUATION OF A HIGH RISK STARTUP WITH RAPID RECURSIVE®

This case study is currently under development and will be posted here soon.

Technical Papers

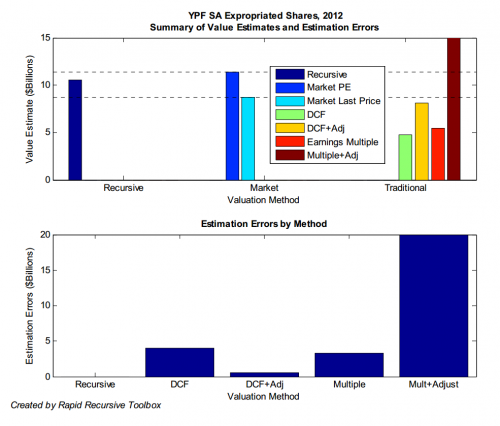

THE VALUE OF A CONTROLLING INTEREST IN AN EXPROPRIATED OIL & GAS COMPANY: YPF SA

PATRICK ANDERSON, MAR 2013

This paper demonstrates the application and benefits of recursive methods for financial valuation. The objective is to value the controlling interest Repsol (Spanish firm) held in the integrated oil and gas corporation, YPF Sociedad Anonima, until its expropriation by the Argentine national government in May 2012.

MICROECONOMIC APPLICATIONS OF THE RAPID RECURSIVE® TOOLBOX

JEFFREY JOHNSON, APR 2013

This technical paper demonstrates the practical application of the Rapid Recursive® Toolbox to five classical sequential decision problems in Economics.

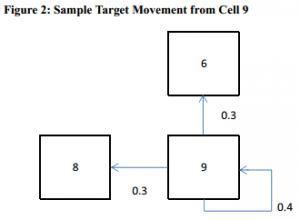

OPTIMAL SEARCH FOR A MOVING TARGET WITH TWO-WAY PATH CONSTRAINTS

JEFFREY JOHNSON, APR 2013

This technical paper presents an application of a novel recursive method, using the Rapid Recursive® Toolbox, to quickly determine an optimal path in the search for a moving target.

VALUING RENTAL PROPERTIES USING A RECURSIVE MODEL

DAVID QUACH, MAR 2013

This technical paper presents a recursive method approach to valuing rental properties. The recursive method is used to calculate the value of an actual rental property in the state of Michigan in the United States. Data used in the valuation model is provided by the property’s owner.

BOOKS

GUIDE TO RECURSIVE MODELS

The Guide, written by Patrick Anderson, has many purposes for its readers. It is used to introduce the concepts of sequential decision problems, and the recursive approach to such problems. It is used to describe a step-by-step process to organize the information necessary to compose a sequential decision problem in a form that can be solved by the Rapid Recursive® toolbox, error-check the model, solve the model, and report the results. Finally, it can be used to present a set of such models that represent common decision problems, and which have already been composed into models that can be immediately solved by the Rapid Recursive® toolbox. Some of these are Solution Templates that are included as part of the software licensed to toolbox users.

In addition, this Guide can assist readers to identify a set of practical issues — such as the selection of discount factors and state variables — for which there is currently no standard convention. It can also provide the reader a set of references on the theory of value functional models, real options, sequential decision problems, related valuation concepts, and the underlying mathematics.

THE ECONOMICS OF BUSINESS VALUATION: TOWARDS A VALUE FUNCTIONAL APPROACH

For decades, the market, asset, and income approaches to business valuation have taken center stage in the assessment of the firm. This book, written by Patrick Anderson, brings to light an expanded valuation toolkit, consisting of nine well-defined valuation principles hailing from the fields of economics, finance, accounting, taxation, and management. It ultimately argues that the “value functional” approach to business valuation avoids most of the shortcomings of its competitors, and more correctly matches the actual motivations and information set held by stakeholders.

Much of what we know about corporate finance and mathematical finance derives from a narrow subset of firms: publicly traded corporations. The value functional approach can be readily applied to both large firms and companies that do not issue publicly traded stocks and bonds, cannot borrow without constraints, and often rely upon entrepreneurs to both finance and manage their operations. With historical side notes from an international set of sources and real-world exemplars that run throughout the text, this book is a future-facing resource for scholars in economics and finance, as well as the academically minded valuation practitioner.